Understanding the Wyckoff Method: A Timeless Strategy for Market Analysis

Understanding the Wyckoff Method: A Timeless Strategy for Market Analysis

The Wyckoff Method is a powerful framework for analyzing price movements and market behavior. Developed in the early 20th century by Richard D. Wyckoff, this method remains highly relevant for traders and investors seeking to understand the underlying forces driving asset prices. Whether you’re trading stocks, crypto, or other financial instruments, Wyckoff’s principles offer a structured way to interpret market cycles and make informed decisions.

What Is the Wyckoff Method?

At its core, the Wyckoff Method is a technical analysis approach that focuses on price action, volume, and market structure. Unlike indicator-heavy strategies, Wyckoff emphasizes reading the market’s “story” through its own behavior. It’s designed to help traders identify accumulation and distribution phases, anticipate trend reversals, and align trades with institutional activity.

Wyckoff believed that large operators—what we now call “smart money”—move markets in predictable ways. By studying their footprints, retail traders can position themselves advantageously.

The Three Laws of Wyckoff

Wyckoff’s framework is built on three foundational laws:

1. Law of Supply and Demand

This law states that price moves in response to the balance between supply and demand.

- If demand exceeds supply, prices rise.

- If supply exceeds demand, prices fall.

- Traders analyze volume and price movement to gauge this balance.

2. Law of Cause and Effect

This principle links the amount of accumulation or distribution (the “cause”) to the resulting price movement (the “effect”).

- A long accumulation phase often leads to a strong uptrend.

- A prolonged distribution phase can precede a sharp decline.

3. Law of Effort vs. Result

This law compares volume (effort) with price movement (result).

- If volume increases but price stalls, it may signal weakness.

- If price moves strongly on low volume, it may indicate a lack of conviction.

The Wyckoff Market Cycle

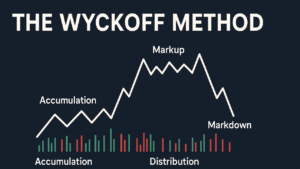

Wyckoff identified four distinct phases in a typical market cycle. Recognizing these phases helps traders align their strategies with the broader trend.

| Phase | Description |

|---|---|

| Accumulation | Smart money buys quietly at low prices. Price moves sideways. |

| Markup | Price rises as demand increases. Public joins the trend. |

| Distribution | Smart money sells into strength. Price consolidates again. |

| Markdown | Price declines as supply overwhelms demand. |

Each phase contains specific price and volume patterns that traders can learn to identify. For example, accumulation often features a trading range with decreasing volume, while markup shows higher highs and higher lows with expanding volume.

Wyckoff’s Five-Step Approach

Wyckoff also developed a practical five-step process for selecting trades:

- Determine the present position and probable future trend of the market.

Use price and volume analysis to assess whether the market is in accumulation, markup, distribution, or markdown. - Select stocks in harmony with the market trend.

Choose assets that are outperforming in uptrends or underperforming in downtrends. - Select stocks with a cause that equals or exceeds your minimum objective.

Analyze the trading range to estimate potential price movement. - Determine the readiness of the stock to move.

Look for signs of breakout or breakdown, such as increased volume or price expansion. - Time your commitment with a turn in the market.

Enter trades when the broader market confirms your analysis.

Why Traders Still Use Wyckoff Today

Despite being over a century old, the Wyckoff Method remains a cornerstone of market analysis. Its emphasis on market psychology, institutional behavior, and price-volume relationships makes it especially useful in today’s algorithm-driven markets.

Modern traders use Wyckoff principles to:

- Identify accumulation zones before breakouts

- Avoid false signals during distribution phases

- Time entries and exits with greater precision

- Understand the “why” behind price movements

Applying the Wyckoff Method to Crypto and Modern Markets

The Wyckoff Method isn’t limited to traditional stocks. It’s widely used in crypto trading, where market manipulation and volatility are common. By studying volume and structure, traders can spot accumulation by whales or distribution before a crash.

For example, Bitcoin’s 2021 price action showed classic Wyckoff distribution patterns before its decline. Traders who recognized the signs were able to exit before the markdown phase.

Wyckoff Method: Final Thoughts

The Wyckoff Method offers a timeless lens for understanding market behavior. By focusing on price, volume, and structure—not just indicators—traders can develop a deeper, more intuitive grasp of market dynamics.

Whether you’re a beginner or seasoned investor, integrating Wyckoff principles into your strategy can improve your timing, reduce risk, and align your trades with the forces that truly move markets.