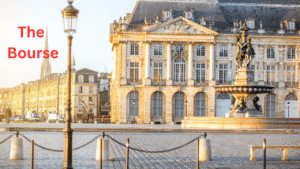

The Bourse: Its Origin, Role, and Significance in the Stock Market

The Bourse: Its Origin, Role, and Significance in the Stock Market

In the financial world, the term “Bourse” holds a prominent place, especially in European markets. While many are familiar with the term “stock exchange,” the word “Bourse” may seem less familiar to some—yet it carries the same meaning in many parts of the world. In essence, a Bourse is a marketplace for the buying and selling of securities such as stocks, bonds, and other financial instruments. However, its historical roots, evolution, and continued significance add layers of depth to what might seem like just another synonym.

Origins of the Term “Bourse”

The word “Bourse” is derived from the Latin word bursa, meaning purse. The origin of the modern usage can be traced back to 13th-century Bruges, in present-day Belgium. According to historical accounts, merchants used to gather at the house of the Van der Beurze family, where commercial transactions and currency exchanges took place. The family’s house featured a coat of arms with three purses, giving rise to the term Beurze Purse, which eventually became simply “Bourse.”

By the 16th century, the concept of a centralized trading venue had spread across major European cities, including Antwerp, Amsterdam, and Paris. These early Bourses laid the foundation for what would later become the modern stock exchanges we know today.

Bourse vs. Stock Exchange

While the terms are often used interchangeably, “Bourse” is typically used in continental Europe and in French-speaking countries, whereas “stock exchange” is more common in Anglo-American financial terminology. Nonetheless, both refer to the same concept: a formal marketplace where financial instruments are traded under regulated rules.

Notable Bourses Around the World

- Euronext: Headquartered in Amsterdam, Euronext is the largest pan-European Bourse and includes markets in Paris, Brussels, Dublin, Lisbon, Milan, and Oslo.

- Bourse de Paris (Paris Stock Exchange): A historical exchange now part of Euronext.

- Deutsche Börse: Based in Frankfurt, Germany, it is a major European financial hub and operator of the Frankfurt Stock Exchange.

- Borsa Italiana: Italy’s main stock exchange, also part of Euronext since 2021.

- BME (Bolsas y Mercados Españoles): Operator of all stock markets in Spain.

Core Functions of a Bourse

A Bourse plays a crucial role in the functioning of modern economies by providing a regulated environment for financial trading. Its key functions include:

1. Capital Formation

The Bourse provides companies with access to capital through the issuance of shares. Companies can go public via Initial Public Offerings (IPOs) and raise funds for expansion, innovation, or debt reduction. This fosters entrepreneurship and business growth, which in turn fuels economic development.

2. Liquidity

By allowing shares to be bought and sold continuously, the Bourse ensures liquidity, meaning investors can easily convert their investments into cash. This liquidity makes investing more attractive, encouraging more participation in the market.

3. Price Discovery

The Bourse acts as a mechanism for price discovery, reflecting real-time changes in supply and demand. Prices of stocks fluctuate based on investor sentiment, economic indicators, earnings reports, and global events. Transparent pricing benefits all market participants.

4. Risk Management

Modern Bourses often include platforms for derivatives trading (such as options and futures), which help investors manage risk. These instruments are used for hedging against price movements in underlying assets.

5. Market Regulation

Bourses operate under the watchful eyes of financial regulators and implement internal systems to ensure fair and transparent trading. Regulations prevent market manipulation, insider trading, and ensure investor protection.

Significance of the Bourse in the Global Economy

The Bourse is more than just a trading platform—it’s a barometer of economic health. Indexes like the CAC 40 (France), DAX (Germany), and FTSE MIB (Italy) track the performance of major companies listed on their respective Bourses and serve as indicators of market sentiment and national economic outlooks.

Moreover, Bourses contribute to financial inclusion by giving retail investors a chance to participate in economic growth. Through brokers and online platforms, anyone with internet access can invest in publicly traded companies, democratizing wealth creation.

Bourse as a Catalyst for Innovation

Publicly traded companies often use the capital raised from Bourses to fund research and development, leading to innovation in fields like technology, healthcare, and energy. In return, investors share in the success through dividends and capital gains, creating a positive feedback loop between capital markets and innovation.

Global Connectivity

In an increasingly globalized world, Bourses are no longer isolated. Many European Bourses have merged or formed alliances to create cross-border trading platforms, like Euronext. Additionally, foreign companies can list on European Bourses, and domestic companies can attract global investors. This interconnectedness makes the Bourse a vital part of the global financial ecosystem.

Challenges and Evolution

While the role of the Bourse is undeniably important, it faces several challenges in the modern age:

1. High-Frequency Trading (HFT)

The rise of algorithmic and high-frequency trading has introduced new volatility and risks to the markets. Bourses must implement safeguards to prevent flash crashes and unfair advantages.

2. Regulatory Pressure

Post-2008 financial crisis, Bourses and financial institutions have faced increased scrutiny and regulatory burdens. While these measures enhance stability, they also increase compliance costs.

3. Technology and Cybersecurity

As Bourses move toward full digitization, cybersecurity becomes a pressing issue. A breach could shake investor confidence and disrupt market operations.

4. Competition from Alternative Trading Systems (ATS)

Dark pools and other off-exchange platforms are attracting trading volumes, posing a threat to traditional Bourses. These systems offer privacy and sometimes better pricing but lack transparency.

5. Sustainability and ESG Pressures

Modern investors are increasingly demanding that companies meet Environmental, Social, and Governance (ESG) standards. Bourses are under pressure to enforce stricter listing requirements and offer ESG-focused indices.

The Future of the Bourse

Despite the challenges, Bourses continue to evolve. Technological advancements like blockchain, AI-driven analytics, and tokenized assets could redefine how securities are traded. For instance, digital securities or security tokens could be listed and traded on regulated platforms, further increasing efficiency and transparency.

Moreover, as decentralized finance (DeFi) gains traction, traditional Bourses may integrate blockchain-based settlement systems to improve speed and reduce counterparty risk.

In addition, Bourses are increasingly embracing sustainability. Initiatives such as the UN Sustainable Stock Exchanges (SSE) partnership promote the adoption of responsible investment practices, making the Bourse a key player in the transition to a greener economy.

Conclusion

The Bourse has come a long way from the merchant houses of medieval Bruges to the high-speed digital trading floors of today. As a cornerstone of the modern financial system, it plays a pivotal role in capital formation, wealth distribution, and economic development. While it faces ongoing challenges from technology, regulation, and shifting investor preferences, its adaptability ensures its continued relevance.

In a world where financial decisions drive innovation and social change, the Bourse is not just a market—it’s a mirror of our collective economic ambitions, and a key player in shaping the financial future of the global economy.